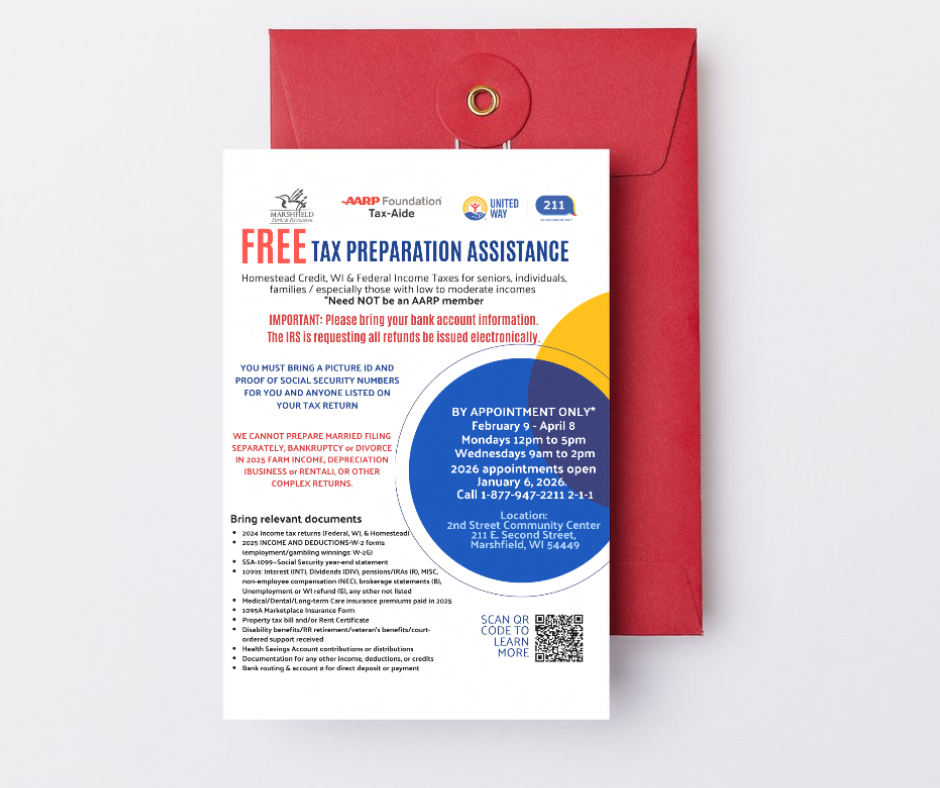

AARP Tax Preparation Assistance

Homestead Credit, WI & Federal Income Taxes for seniors, individuals, families / especially those with low to moderate incomes

*Need NOT be an AARP member

WHEN: *BY APPOINTMENT ONLY* February 9, 2026 to April 8, 2026

Mondays 12pm to 5pm or Wednesdays 9am to 2pm

WHO: Seniors, individuals, and families / especially those with low to moderate incomes

WHAT: Homestead Credit, Wisconsin & Federal Income Taxes

WHERE: 2nd Street Community Center, 211 E Second Street, Marshfield WI 54449

IMPORTANT: Please bring your bank account information. The IRS is requesting that all refunds be issued electronically.

CALL UNITED WAY’S 211 BY SIMPLY DIALING 2-1-1 OR 1-877-947-2211

* WE CANNOT PREPARE MARRIED FILING SEPARATELY, BANKRUPTCY, or DIVORCE IN 2025, FARM INCOME, DEPRECIATION (BUSINESS or RENTAL)

Bring relevant documents

- 2024 Income tax returns (Federal, WI, & Homestead)

- 2025 INCOME AND DEDUCTIONS•W-2 forms (employment/gambling winnings: W-2G)

- SSA-1099--Social Security year-end statement

- 1099s: Interest (INT), Dividends (DIV), pensions/IRAs (R), MISC, non-employee compensation (NEC), brokerage statements (B), Unemployment or WI refund (G), any other not listed

- Medical/Dental/Long-term Care insurance premiums paid in 2025

- 1095A Marketplace Insurance Form

- Property tax bill and/or Rent Certificate

- Disability benefits/RR retirement/veteran’s benefits/court-ordered support received

- Health Savings Account contributions or distributions

- Documentation for any other income, deductions, or credits

- Bank routing & account # for direct deposit or payment

MyFreeTaxes helps people file their federal and state taxes for free while getting the assistance they need. United Way provides MyFreeTaxes in partnership with the IRS’s Volunteer Income Tax Assistance (VITA) program to help filers prepare their tax returns on their own or have heir return prepared for them for free.

Learn More by clicking here: MyFreeTaxes by United Way | MyFreeTaxes

As the year winds to a close, many of our supporters are considering how to make the greatest impact before December 31. If you’re 70½ or older, you have a unique way to give — one that can benefit both you and the community.

A Qualified Charitable Distribution (QCD) allows you to give directly from your IRA to Marshfield Area United Way. Your gift counts toward your required minimum distribution (RMD) and can reduce your taxable income — all while strengthening programs that make a big difference in the lives of working families in our community.

If you’d like to make a QCD gift before year-end, simply contact your IRA custodian or financial advisor. Our tax ID number is 39-1035075.